How Much Do You Really Need to Retire Comfortably in Malaysia?

A Malaysian’s Guide to Enjoying Retirement Without Financial Worry

“How much do I actually need to retire?”

If I had a Ringgit every time someone asked me this, I’d have my own retirement covered ( You got what I mean)

It’s easily the number-one question I get from Malaysians planning for their future.

And here’s the honest answer: There isn’t one magic number. There’s your number—based on your life, your habits, your dreams, and yes, your level of discipline.

But let’s not be dramatic. Let’s talk about it properly.

The “Magic Number” Isn’t Magic

Too many people think retirement is a vague fantasy. “One day I’ll stop working, relax on a beach, and my EPF will magically stretch forever.”

Sorry, but no.

Retirement is real. It’s a long, expensive chapter of your life. It deserves planning as carefully as you plan your next family wedding.

Step 1: Figure Out Your Spending

First question: How much do you need to spend each month in retirement?

Rule of thumb? About 80% of your current expenses.

So if you’re spending RM10,000 a month now, plan for at least RM8,000 after you stop working.

Of course, you might plan for less if you want to downsize. Or more if you intend to “upgrade” your life after retiring. The key is to be honest with yourself.

Step 2: Pick Your Retirement Age

When do you want to stop working?

55? 60? 65?

This number matters a lot. The earlier you retire, the more years you’ll need to fund.

Many people in Malaysia talk tough: “I’ll work till I die lah.” But I’ve seen what happens when health fails or jobs dry up. Planning for an age gives you power.

Step 3: Don’t Ignore Inflation

Ah yes—the silent thief.

Your RM8,000 a month today won’t buy the same things 20 years from now.

If we assume 4% annual inflation (a pretty normal estimate here), RM8,000 today becomes RM17,500 in 20 years just to buy the same groceries, pay the same bills.

Ignore inflation at your own risk. It’s like refusing to pay toll and expecting the boom gate to open.

Step 4: Decide Your Investment Return

This part is crucial.

Your savings don’t just sit in a safe. They should be working for you.

Fixed deposits (3–4%): Safe, but usually too slow to beat inflation.

Passive investing (6-10%): Dividend stocks, index funds. Suitable for many people.

Active investing (10–20%): Higher skill and risk, but powerful returns if you know what you’re doing.

Your chosen approach changes your whole plan.

Step 5: Understand the Three Retirement Strategies

There’s no single “correct” strategy. But you have options:

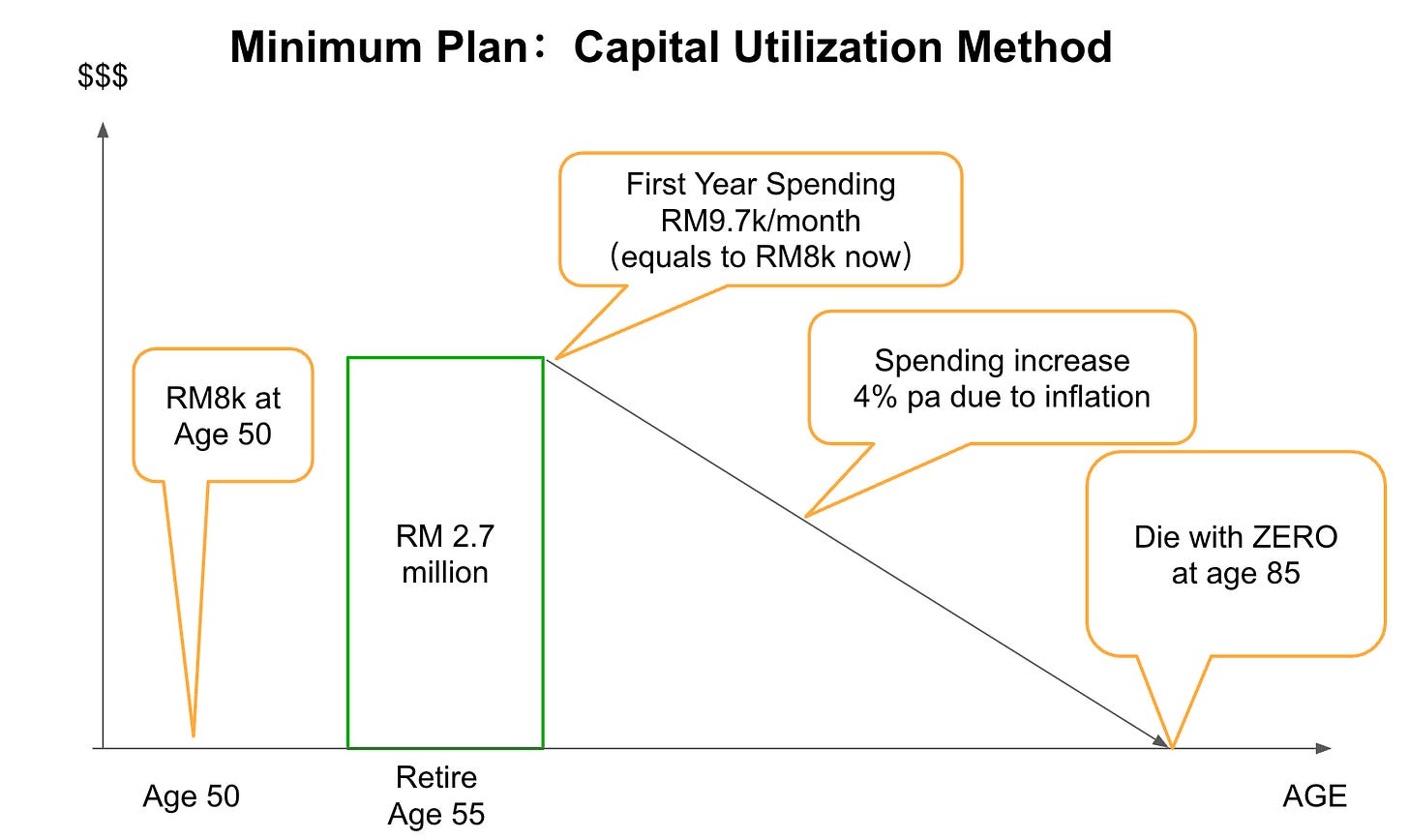

Capital Utilisation

You spend all your savings until they hit zero at the end of your life. It’s “use it all.” Cheaper to plan for, but risky if you live longer than expected or face surprises.

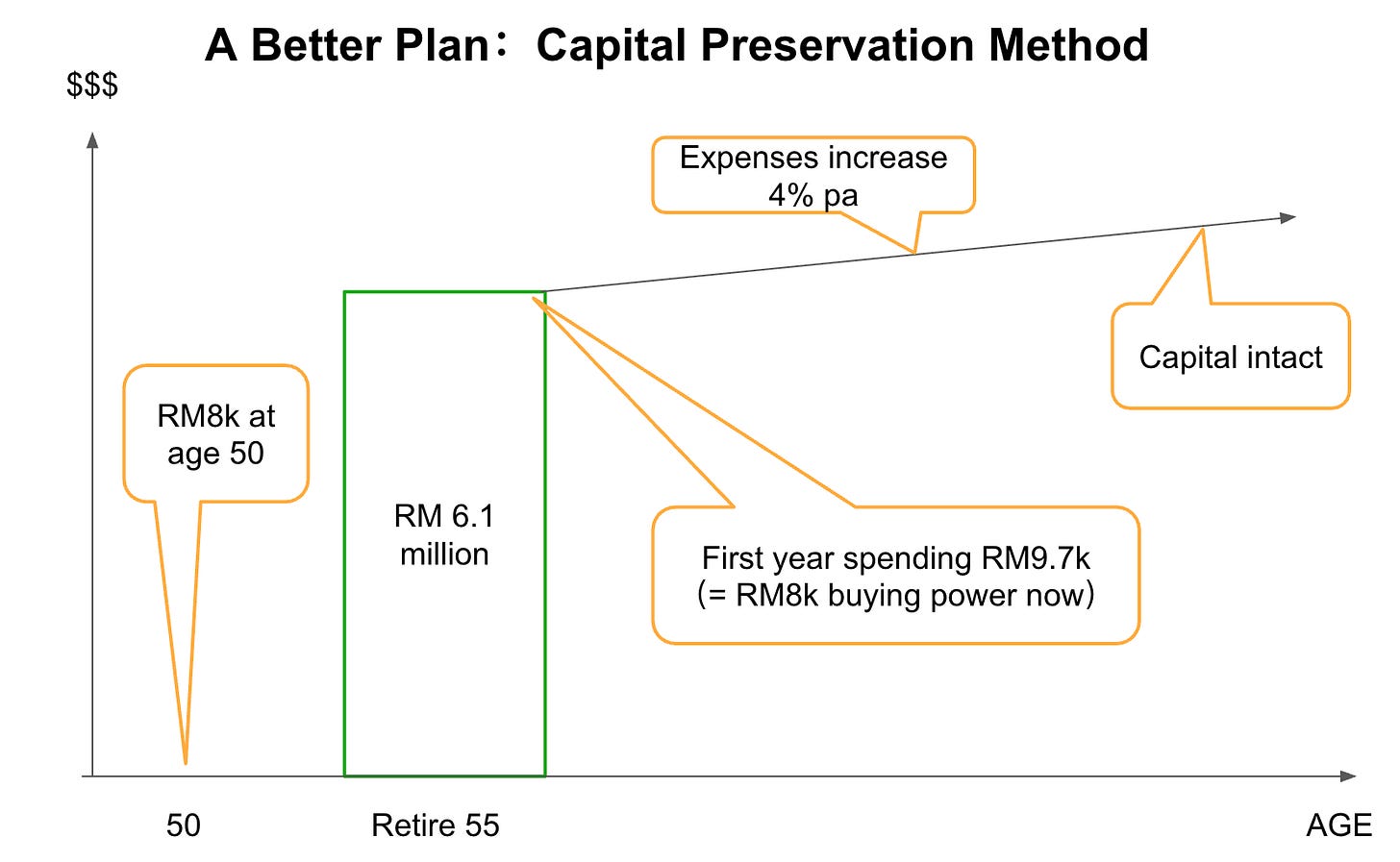

Capital Preservation

You only spend the returns, keeping your capital intact. Safer, but you’ll need a much bigger nest egg.

Capital Growth

The best scenario. Your investments not only cover your costs but keep growing. You can spend with confidence, enjoy better healthcare, travel, and even leave a legacy for your children.

Case Study: Mr. and Mrs. Tan

Let’s bring it home with an example.

Mr. and Mrs. Tan are both 50. They want to retire at 55.

Target spend: RM8,000 a month in today’s money.

Inflation: 4%.

Expected investment return: 6%.

Retirement duration: 30 years.

Capital Utilisation plan: ~RM2.7 million.

Capital Preservation plan: ~RM6.1 million.

See the difference?

Your approach matters as much as your starting point.

Practical Tips for Real Life

Let’s not pretend it’s all theory. Life is unpredictable.

Manage Inflation

Be prepared to tighten your belt when prices rise. Less shopping mall therapy, more mindful spending. Prioritise needs over wants.

Plan for Healthcare

Medical costs are unavoidable, but you can manage them. Pick affordable options. Stay healthy to avoid big hospital bills.

Choose Where You Live

Moving to a cheaper town can save you big bucks. True, moving overseas for cost reasons isn’t so realistic for Malaysians (we’re already pretty cheap by world standards!), but you can be smart about local choices.

Why Returns Matter So Much

Here’s the brutal truth.

If you save RM2.7 million and get just 4% returns, your money runs out in 23 years. Not enough if you live to 85.

At 6%, it just about covers 30 years, but with no room for error.

At 12%, it covers your spending and grows.

This is why I’m always nagging you to learn how to invest.

The Best Time to Learn? When You’re Young

Time is your biggest asset. Learn early. Make your mistakes while you have decades ahead of you. Let compounding do the heavy lifting.

Like planting oil palm—plant it early if you want a good harvest.

The Second-Best Time? Now

Missed your twenties and thirties? Start now.

It’s better than waiting. Every day you delay is one less day for your money to grow.

Don’t Wait Until You’re Retired

If you only start learning to invest after you retire, you’re in trouble.

No time to recover from mistakes. No room for trial and error. Every Ringgit lost is your living money.

Hard Truth

There’s no magical solution waiting in EPF, ASB, PRS.

If you don’t plan, don’t save, and don’t invest wisely, your retirement might mean cutbacks, worry, regret.

That’s not what you want.

So do the work. Plan. Learn. Invest. Repeat!

They say: “The best time to plant a tree was ten years ago. The second-best time is now.”

Your retirement plan is that tree. Plant it. Nurture it.

Your future self will thank you.

If you want to talk about your retirement plan, your investments, or even just want to figure out where to start, drop me a message.

I’m here to help you be smarter with money.